Understanding Business Valuation: A Comprehensive Guide for Startups

What is Business Valuation and Why It Matters

Business valuation is the process of determining the economic value of a company. It involves assessing various aspects of a business, including its assets, liabilities, income, and market conditions, to estimate its worth. Several methods, such as discounted cash flow (DCF) and comparable company analysis, can be used to perform this valuation. We’ll explore these methods in detail later in the article. Overall, business valuation is crucial as it impacts many aspects of a business, from daily operations to long-term strategic decisions. Accurate valuation provides stakeholders with clarity and confidence, ensuring informed choices based on the company’s true worth.

Why Business Valuation is Important:

- Investment Decisions - Investors need to know the value of a company to make informed investment decisions. It helps them assess whether a company is overvalued or undervalued based on its financial health and market position.

- Mergers and Acquisitions - In M&A activities, understanding the true value of a business is essential for negotiations and ensuring a fair price is paid. It also helps in structuring the deal effectively.

- Strategic Planning - Business owners use valuations to make strategic decisions, such as expanding operations, entering new markets, or selling a stake in the company. Knowing the company’s worth allows them to make decisions that align with their long-term goals.

- Raising Capital - When seeking funding, whether through equity or debt, businesses need to present a clear valuation to potential investors or lenders. This helps in securing the required capital under favorable terms.

- Exit Strategy - For business owners planning to exit, understanding the value of their company is essential to maximizing their return. A well-conducted valuation ensures they receive a fair price for their hard work and investment.

- Legal Reasons - Business valuations are often required for legal purposes, such as divorce settlements, shareholder disputes, or estate planning. It provides an objective basis for resolving such issues.

Key Methods of Business Valuation

A company can be valued in various ways, each offering a different perspective on its worth. No single method is universally correct, so multiple methods are often used together to cross-check results.

.png)

- Market-Based Valuation Approach

- Overview: This approach estimates a business's value based on how similar companies (or assets) are priced in the market, using data from comparable companies, transactions, or stock market information.

- Methods Included:

- Comparable Company Analysis (CCA)

- Overview: CCA, also known as "comps," involves comparing the target company to similar companies in the same industry that are publicly traded. Key metrics like price-to-earnings (P/E) ratios, EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization), and revenue multiples are used to estimate the company's value.

- When to Use: Commonly used when there’s a market for similar businesses, making it a quick and practical approach.

- Precedent Transactions Analysis

- Overview: This method involves analyzing the prices paid for similar companies in past transactions. It provides a benchmark based on historical deals in the same industry, adjusting for differences in size, market conditions, and other factors.

- When to Use: Useful in M&A scenarios. It’s particularly relevant when recent transactions are available and closely resemble the company being valued.

- Market Capitalization

- Overview: For publicly traded companies, market capitalization is calculated by multiplying the current stock price by the total number of outstanding shares, reflecting the market's view of the company's value.

- Income-Based Valuation Approach

- Overview: Values a business based on its ability to generate income or cash flow in the future by forecasting future earnings or cash flows and discounting them to present value.

- Methods Included:

- Discounted Cash Flow (DCF) Analysis

- Overview: Estimates a business's value based on its future cash flows, discounted back to their present value using a discount rate that reflects the risk associated with the business.

- When to Use: Ideal for businesses with stable and predictable cash flows. It's particularly useful in valuing companies with strong growth potential or those in industries with significant future earnings.

- Earnings Multiplier Method

- Overview: Values a business based on a multiple of its current earnings, adjusted for non-recurring expenses or income.

- When to Use: Frequently used for small to mid-sized businesses. It’s simple and provides a quick estimate of value, particularly when historical earnings are a strong indicator of future performance.

- Asset-Based Valuation Approach

- Overview: Values a business based on the value of its assets minus liabilities, focusing on the company's balance sheet rather than income or market comparisons.

- Methods Included:

- Asset-Based Valuation

- Overview: Asset-based valuation determines a company's value by calculating the net asset value (NAV) of its assets minus its liabilities. This method can be approached from a going concern perspective (assuming the company continues to operate) or a liquidation perspective (assuming the company is dissolved and assets are sold off).

- When to Use: Best suited for companies with significant tangible assets, such as real estate or manufacturing companies. It’s often used for businesses that are not generating enough cash flow or when considering liquidation.

- Book Value

- Overview: Calculates a company's value based on its balance sheet, specifically its assets minus liabilities. It reflects the accounting value of a company's equity.

- When to Use: Often used as a baseline in valuations, particularly for businesses in financial distress or industries where asset value is more reflective of the business's worth than earnings potential.

- Liquidation Value

- Overview: Liquidation value is the net cash that a business will receive if its assets are liquidated and its liabilities are paid off today.

Choosing the Right Method

The choice of valuation method depends on various factors, including the type of business, the purpose of the valuation, and the availability of relevant data. Often, multiple methods are used in conjunction to cross-check results and provide a more comprehensive valuation.

Common Challenges in Business Valuation

- Lack of Reliable Financial Data - Early-stage companies often have limited financial history, making valuations more speculative.

- Subjectivity in Assumptions - Different assumptions (growth rates, discount rates) can lead to varying valuations.

- Market Volatility - Fluctuating market conditions can quickly render valuations outdated.

- Valuing Intangible Assets - Estimating the value of intangibles like patents and goodwill is challenging.

- Choosing the Right Method - Using an inappropriate valuation method can skew results.

- Non-Recurring Items - One-time expenses or gains can distort financials if not adjusted properly.

- Valuing Synergies in M&A - Estimating the value of synergies in mergers and acquisitions is difficult and speculative.

- Regulatory and Legal Differences - Varying laws and regulations can complicate valuations, especially in cross-border deals.

- Estimating Future Growth - Predicting future growth accurately is tough, particularly in dynamic industries.

- High Uncertainty - Valuing companies in uncertain environments (startups, emerging markets) involves significant guesswork.

Addressing these challenges involves using multiple methods, refining assumptions, and staying informed on market conditions.

Business Valuation for Startups vs. Established Companies

Key Differences:

- Methodology - Startups rely on potential and growth-based methods, while established companies use performance and asset-based methods.

- Data Availability - Startups have limited financial data, while established companies provide robust historical data.

- Uncertainty - Startup valuations are more speculative due to higher uncertainty, whereas established companies offer more predictable valuations.

Startup valuations emphasize future potential and qualitative factors, while established company valuations focus on historical performance and market comparables.

The Importance of Professional Valuation Services

Professional valuation services offer essential expertise, objectivity, and accuracy, which are crucial for informed decision-making, legal compliance, and successful business transactions. They help ensure that the true value of the business is recognized and maximized.

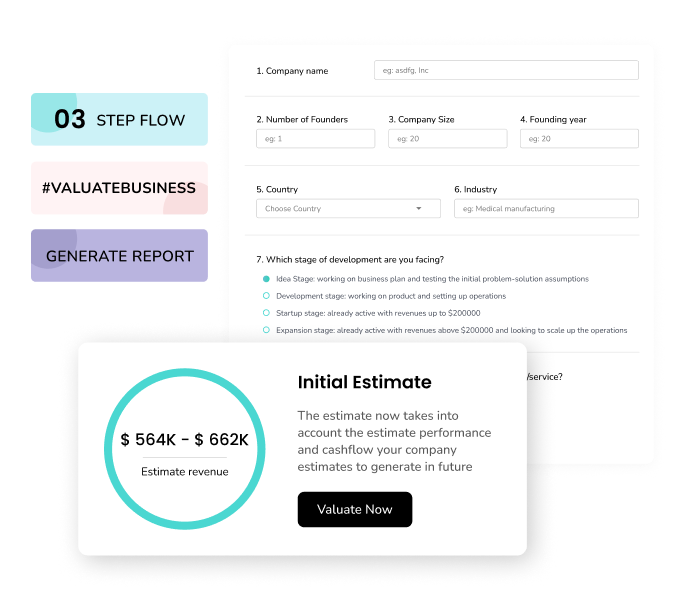

Introducing Zefyron’s Business Valuation Tool

Not Just a Valuation—A Strategic Roadmap for Your Business’s Future

Zefyron’s business valuation tool delivers precise valuations with accuracy, leveraging advanced algorithms and data. Real-time reports are available for download in three easy steps. By streamlining complex calculations, Zefyron empowers users to make informed decisions quickly, saving up to 80% in valuation time compared to traditional methods.

The tool serves as a foundation for transparent negotiations, presenting the company’s valuation, financial projections, and other critical details, and adjust parameters directly on the platform.

Get Your Valuation Report in 3 Easy Steps:

- Questionnaire

- Financial Information

- Funding Round

Simplify the evaluation of your startup by simply entering your existing details.

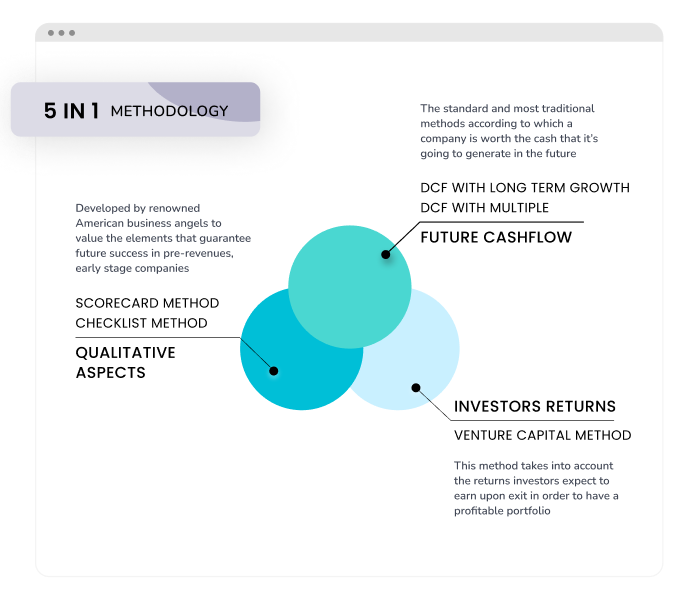

Zefyron assesses future cash flows, investor returns, and qualitative factors using five different methodologies to ensure a comprehensive valuation:

- Scorecard Method

- Checklist Method

- DCF with Long-Term Growth

- DCF with Multiple

- Venture Capital Method

These approaches provide a fair value of your business, giving you a holistic view rather than a narrow perspective.

Get a Valuation That Maps the Way!

Get to know what approach Zefyron uses to Valuate your business

- Scorecard Method

- Checklist Method

- DCF with Long-Term Growth

- DCF with Multiple

- Venture Capital Method

Adjusts a startup's valuation based on comparison to a benchmark.

Example: An early-stage tech startup is compared to a similar company that recently sold for $10 million. The investor adjusts this benchmark by evaluating the startup's management team, product, and market. If the startup’s team is stronger, the valuation might be adjusted up by 20%, resulting in a valuation of $12 million.

Scores a startup against key success factors to estimate its value.

Example: A healthcare startup is evaluated against criteria like market potential, product innovation, and customer traction. Each factor is scored out of 10, and the total score suggests a valuation range. If the startup scores 75 out of 100, it might be valued at $7.5 million.

Values a company by projecting future cash flows and extending them with a long-term growth rate, then discounting them to the present.

Example: A mature retail company projects $5 million in cash flows annually for the next 10 years, with a 3% long-term growth rate. These future cash flows are discounted to their present value, leading to a current valuation of $50 million.

Calculates a company’s terminal value using a market-based multiple, then discounts it to the present to estimate current value.

Example: A software company is expected to earn $10 million in its terminal year. The industry multiple is 8x earnings, giving a terminal value of $80 million. After discounting, the present value of the company might be $60 million.

Estimates a startup’s future exit value, then works backward to determine its current valuation, adjusting for risk and desired ROI.

Example: A startup is projected to be sold for $100 million in 7 years. The VC targets a 10x return on investment. To achieve this, they value the company today at $10 million, adjusting for the high risk and time horizon.

Get a 21+ Page Detailed Valuation Report with Analytics and Insights

Share it within our platform, which includes a database of over 2 million startups and 350K investors, facilitating fundraising through connections and networking. Or import the file with ease—your privacy and data are protected.

Get Your Instant Business Valuation Report by Zefyron Now

Sign Up for Free: Zefyron