Startup Funding Platform:

All you need to know about them

An online marketplace or platform known as a startup funding platform connects businesses and entrepreneurs looking for capital with possible investors. These platforms offer a variety of assets and instruments to assist entrepreneurs in showcasing their business concepts, making connections with investors, and obtaining money. Entrepreneurship is a herculean task, especially when it comes to funding. Thankfully, there are now a variety of startup funding platforms available for entrepreneurs to access capital..

Key Characteristics of an Ideal Startup Funding Platform

- Amongst a plethora of options available, choosing the right startup funding platform is crucial to the success of the business. Here are some factors to consider when identifying an ideal startup fundraising platform-

- Fundraising type

Various fundraising platforms, such as equity crowdfunding, vc platforms, corporate investors platforms, or angel investors platforms, specialise in particular sorts of finance. Select a platform that provides the kind of financing the company needs. - Investor network:

The platform must have a sizable and varied network of investors, including institutional, angel, and venture capitalists. Finding the ideal investor for the company is more likely when you have a large investor network. - Track record:

Look into the platform's past, including the number of profitable crowdfunding campaigns, the categories of companies they have backed, and the success rates of those companies. - Charges:

Funding platforms typically levy a price for their services. Look for a platform that charges fair and transparent costs. Take into account the platform's pricing structure, including any extra costs like listing or transaction fees. - Additional resources:

Take into account the assistance and resources that the platform provides. In order to succeed, choose a platform that provides networking opportunities, business coaching, and mentoring. Some platforms also offer other tools, such as financial and legal services, to aid you in navigating the funding process. - User experience:

Lastly, think about how the platform is used. Look for a platform with simple controls, directions, and instructions that are straightforward to follow. Verify user ratings and reviews to make sure the platform has a positive reputation.The above-mentioned characteristics aid an entrepreneur in identifying the ideal funding platform.

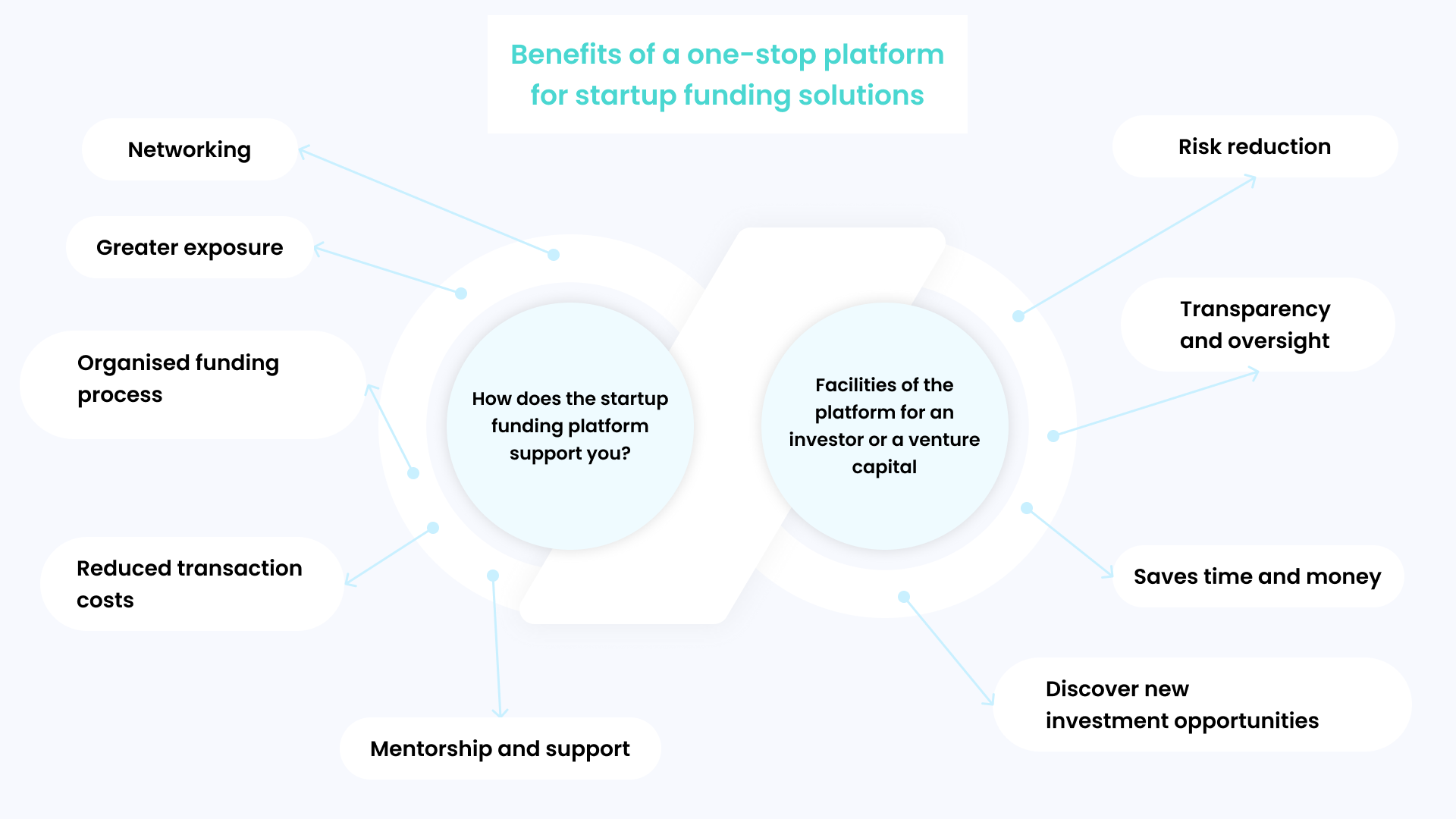

Benefits of a one-stop platform for startup funding solutions

- A fundraising platform provides a variety of benefits not just to startups but to investors as well seeking funding.

- How does the startup funding platform support you?

- Networking - A startup fundraising platform often includes a significant and broad network of investors, including angel investors, venture capitalists, and institutional investors. Startups now have access to a wider variety of possible investors than they would have through more conventional funding channels.

- . Greater exposure: A startup fundraising platform can help a startup become more visible and accessible to potential investors. Many platforms offer marketing and promotional services to aid entrepreneurs in showcasing their businesses and luring investors.

- Organised funding process: By streamlining the funding process, a startup funding platform may make it simpler and more effective for businesses to raise money. Numerous platforms provide materials and tools to assist companies in developing engaging pitches and presentations and establishing connections with possible investors.

- Reduced transaction costs: Compared to conventional funding options like using a broker or investment banker, platforms are more affordable.

- Mentorship and support: To aid companies in navigating the fundraising process and expanding their businesses, some startup funding platforms provide mentorship and support services. For first-time business owners who might not be familiar with the fundraising process, this can be extremely helpful.

Facilities of the platform for an investor or a venture capital

- Investors and venture capital firms benefit greatly from such platforms. Mentioned below are some key benefits-

- Discover new investment opportunities- Investors have access to a broad range of firms looking for investment thanks to startup funding platforms. This makes it possible for investors to diversify their portfolios and find new investment options.

- Saves time and money: Investors can save time and money by using a startup funding platform to find and assess possible investment opportunities. By providing them with carefully curated startup prospects based on their investment requirements, the platform does the legwork for the investors.

- Risk reduction: By offering investors a plethora of knowledge and resources to aid in the evaluation of possible investments, a startup funding platform can assist investors in reducing risk. Access to thorough company strategies, financial forecasts, and details on the management team are all included.

- Transparency and oversight: A lot of startup funding platforms give investors information on the startup's performance and status, as well as transparency into the investment process. This oversight can assist investors in making more informed investment selections.

What are some of the best crowdfunding platforms to work in 2023

- There exist various crowdfunding platforms. Mentioned below are some of the popular platforms with respect to different countries.

- Popular Startup funding platform in Germany, Switzerland and Austria (GSA) Companisto: Companisto is a German crowdfunding platform that provides venture loans, mezzanine finance, and equity-based crowdfunding solutions for start-ups and early-stage businesses.

- Conda: Conda is an Austrian crowdfunding platform that provides venture loans, mezzanine finance, and equity-based crowdfunding solutions for start-ups and early-stage businesses.

- 100-days: 100-days is a Swiss crowdfunding platform 100-Days that provides startup and early-stage businesses with equity-based crowdfunding solutions. The platform provides a straightforward and user-friendly interface for investors and startups.

Popular Crowdfunding platforms in Asia

- CrowdPlus.asia- The company, which is situated in Malaysia, is an equity crowdfunding platform supported by Netrove Ventures Group, a local venture capital firm focused on technology.

- Wishberry- An Indian crowdfunding site with an emphasis on the arts and entertainment. Wishberry provides rewards-based crowdfunding solutions for original and creative projects.

- Campfire- Campfire provides rewards-based crowdfunding possibilities for original and creative projects as well as fundraising efforts for charities and nonprofits.

Conclusion:

- In conclusion,The secret to selecting a successful fundraising platform is to have a firm grasp of the company model, a strong business plan, and a strategy for allocating cash. It is crucial to conduct research, be ready to change course and be persistent in your pursuit of funds